The rise of the side hustle

In March this year, a new national report released by ING in Australia revealed nearly half (48%) of the Australians surveyed either have or are

How we can improve the teaching of financial literacy in high school? And why is it important?

People need a basic understanding of financial concepts to make good financial decisions. Our newly released research found most students generally do not know a lot about personal finance. This includes being able to apply basic numeracy to real-life financial situations, such as making purchasing decisions that are value-for-money and understanding interest on loans and investments.

Our report also makes six recommendations to improve financial literacy education in schools.

Our findings were consistent with previous evidence that 16% of Australian 15-year-olds lack even the basic level of financial literacy they need to participate in society. There is evidence that financial literacy in this age group is declining.

This trend is concerning. The senior years of high school are a time when students take on more personal responsibility and financial independence. The financial habits they form then may last through adulthood. Low financial literacy is persistently linked to poorer financial outcomes.

The Australian Curriculum acknowledges students need financial literacy to operate in our financial world. However, this curriculum only covers up to year 10. In years 11 and 12, the years that are particularly important in shaping students’ financial capability, financial literacy is taught only in lower-level maths subjects.

Our research explored the financial literacy of students in years 10, 11 and 12 at two urban and two rural schools. We found what students do know about financial literacy has been learned from home, maths or business studies. Students who were undertaking business studies were far more informed than other students.

Home life has been found to have a huge impact on a child’s financial literacy. There are often calls for parents to teach their children about personal finance. However, that assumes parents are able and willing to do that.

The students we spoke to were incredibly diverse. Household structures varied greatly, with many students not living with their parent/s. There was also evidence of parents not being able to provide financial guidance.

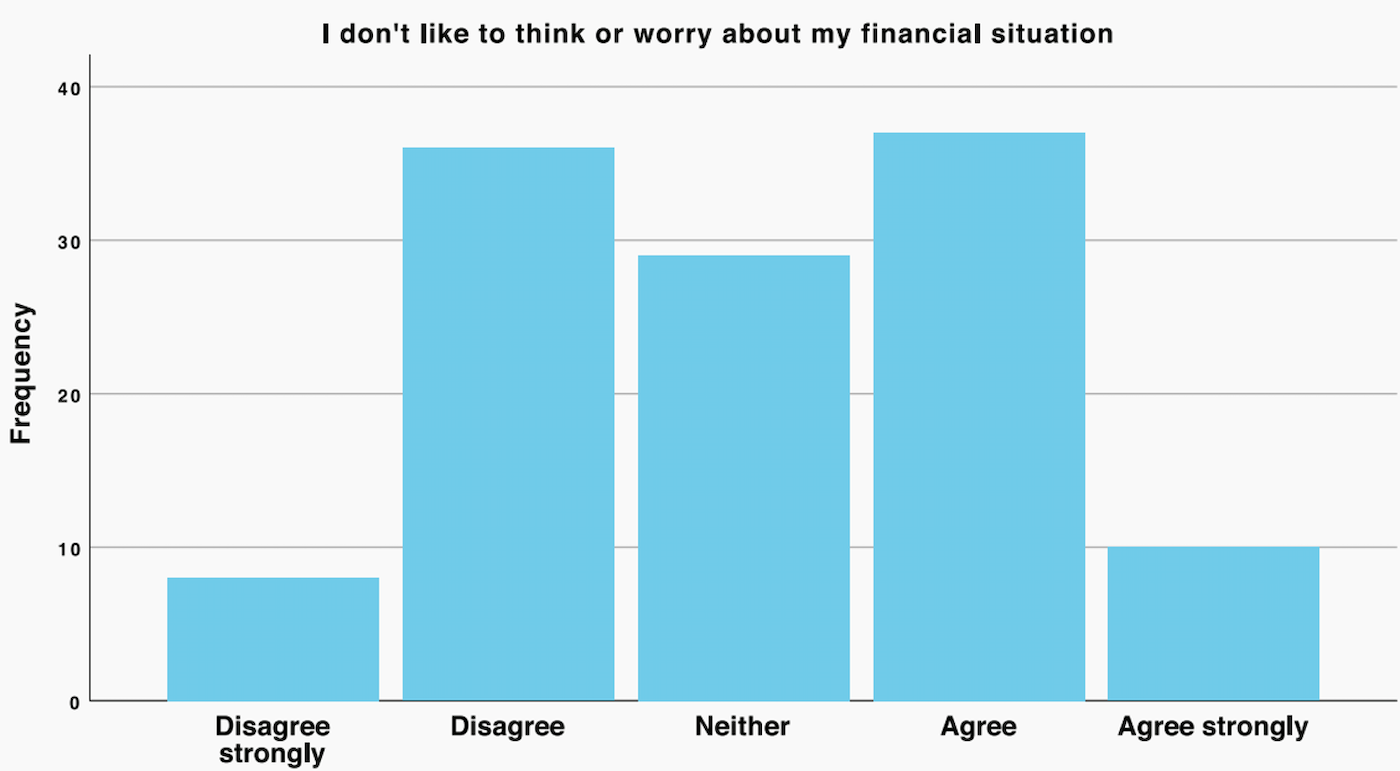

Nearly half the surveyed students preferred not to think about their financial situation.

We talked to a lot of the students about maths and found this was not the most effective curriculum area for learning about personal finance. When taught as part of the maths curriculum it tends to result in students fixating on formulas and calculations, without understanding the underlying concepts. As one student said:

Many students also dislike maths. This means they are disengaged from learning at the outset. One student told us:

There was also often a disconnect between the financial scenarios students were learning about and their experiences in their own lives.

Students who could remember financial concepts would often recall an experience or something from history when talking about it. This suggests stories may be more effective in communicating financial concepts. For example, one student said of inflation:

Finally, we noted many students were not learning financial strategies, such as moderating spending, that have lifelong benefits.

Given the importance of financial literacy for student well-being, our report makes these recommendations:

Originally published in The Conversation

“Financial Literacy for Young Australians” is a free resource from Financial Basics Foundation, a non-profit organisation that provides free financial literacy resources to educators around Australia.

Dr Laura de Zwaan is a lecturer in Finance and Financial Planning at Griffith University in the Department of

Accounting, Finance and Economics. She completed her PhD at Griffith University in 2013 in the area of superannuation and ESG investing.

Laura’s research interests encompass most areas of superannuation, including fund investment policies, member decision-making, gender issues, taxation, and fund governance. In addition, she has a strong interest in financial literacy and capability, especially with regards to vulnerable cohorts. She has published widely in journals such as Critical Perspectives on Accounting, Accounting, Auditing and Accountability Journal, Financial Services Review, and the Journal of Australian Taxation.

Dr Tracey West has a strong background in household finance, with several publications on household finance, financial literacy and financial planning issues, including a PhD thesis completed in 2016.

Recent work has been published in Economic Notes, Financial Counselling and Planning, Financial Planning Research Journal, Journal of Family and Economic Issues, JASSA, the Consumer Interests Annual. Dr West’s work contributes to knowledge on investor behaviour, informing curriculum development and guidance for advisors in the financial services industry.

Follow Tracey on Twitter

In March this year, a new national report released by ING in Australia revealed nearly half (48%) of the Australians surveyed either have or are

Climate responses are often distant global discussions that don’t translate to the everyday lived experience of local communities. The embeddedness of community radio in the social and cultural lives of their communities is an untapped reservoir to communicate climate action and pursue climate justice.

We’ve entered 2021 having lived through unimaginable disruption and facing much more, we might well ask ourselves: Will COVID-19 cause a fundamental reimagining of our relationship with cities?