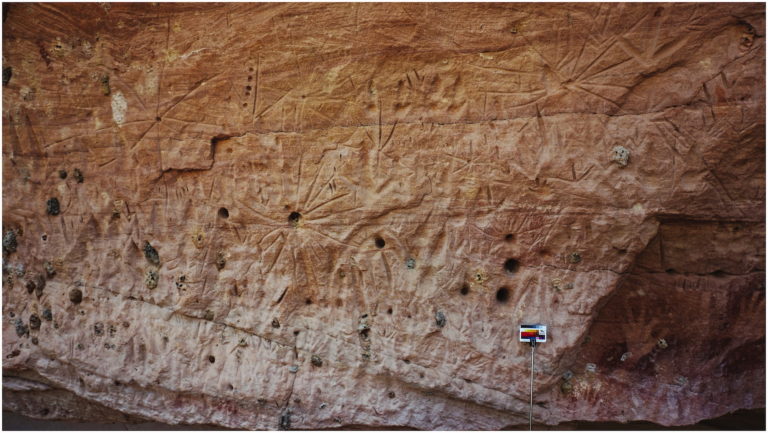

Marra Wonga’s Seven Sisters story

Marra Wonga is a large sandstone rock shelter and art site near Barcaldine, central Queensland. There are estimated to be at least 15,000 petroglyphs, mostly animal tracks, lines, grooves and drilled holes, as well as 111 hand-related and object stencils spread across 160 metres.